Service Innovation Case Study: Seamless Account Opening

Customer input was asked last year to help design the customer experience of a new banking product for a prominent bank in the United Arab Emirates. This service innovation case study shows that creating an optimal customer experience, even for an online product, requires looking at more than a single customer touch-point but at the overall product and service design and delivery.

The goal of the project was to create an online product that would provide value to target customers according to their needs. With increasing consumer trust in online banking and transactions over the internet, online-only savings accounts have gained popularity in the recent years. Many banks already offer such types accounts to consumers, and later adopters are starting to offer them to meet the competition.

As a first step of the project, we helped identify the value propositions to focus on and established customer experience goals.

Being an online savings account, it makes sense that it can be applied for online. One of the determining factors in the conversion rates from visitors to customer would be the usability of the application form in terms of ease of use, efficiency and speed.

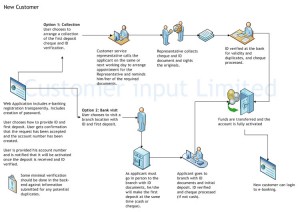

The process for existing customers who already have e-banking access would be simple. They could simply logon, and transfer the initial required minimal deposit into the new account, creating it at the same time. However two other types of customers would not be able to go through an online-only process. Existing customers without online banking access would need to make their initial deposit and potential new customers would also need to produce their identification documents.

Understanding Customer Value

Initially the bank would have had new customers go to a branch to make their first deposit and produce their identification documents. However, the very customer value proposed by an online account is the convenience of doing everything online. Therefore asking customers to go to the bank in the middle of an online application would go against the very value proposed by the product.

Service Innovation

With customer value in mind, we took a holistic approach to the registration process and designed not only the online application, but offline logistics procedures as well.

Instead of having customers come to the bank, we designed in detail an innovative process that would take the bank to the customers. In the online registration process, we seamlessly integrated the options for potential customers to set up an appointment to have their initial deposit cheque picked up and identification documents verified by an authorized bank representative.

While this may create security concerns, the onus is on the Bank to ensure the process is safe for both the Bank and the customers. Innovation isn’t always the easiest solution, and doesn’t happen maintaining the status quo. It sometimes requires establishing new protocols. Companies cannot differentiate themselves anymore only on product features. Many banks offer online savings accounts all pretty much the same features. The differentiator is not the end product anymore, it is the better experience around the product, through service innovation. And being the first mover creates a significant advantage over competitors.

Tagged: | Customer Experience, Finance, Innovation, Service Design

David Jacques is Founder and Principal Consultant of Customer input Ltd and a pioneer in the field of Customer Experience Management. He has created the first Framework that brings together cohesively every aspect of Customer Experience Management. He is also passionate about having an in-depth understanding customer values to create emotionally-engaging customer experiences not only at individual interactions but also seamlessly between them.

All posts by David (30) - Connect on: LinkedIn - Twitter

Leave a Reply